In the midst of ongoing tariff wars and rising import duties in the United States, sourcing flooring tiles from India has emerged as a strategic advantage for American importers and businesses. India’s tile industry stands out globally for its cost-effective production, access to abundant raw materials, and robust manufacturing capabilities, allowing suppliers like Ramirrro Ceramica to offer high-quality, competitively priced tiles in a vast array of designs and finishes. As the world’s second-largest tile exporter, India’s products are not only renowned for their durability and variety, but also benefit from favorable trade agreements and relatively low U.S. import tariffs, ensuring affordability even during periods of trade uncertainty.

What Are Reciprocal Tariffs — And How Will They Impact Chinese vs Indian Tile Manufacturers?

Reciprocal tariffs are import taxes that one country imposes on another’s goods in direct response to tariffs that the other country places on its exports, aiming to create a level playing field in trade. Under this mechanism, if Country A levies a 15% tariff on Country B’s products, Country B may retaliate by imposing a similar 15% tariff on Country A’s goods, effectively mirroring the trade restrictions. The primary goal of reciprocal tariffs is to protect domestic industries from unfair foreign competition and to pressure trading partners into reducing their tariffs or trade barriers.

Regarding the impact on Chinese versus Indian tile manufacturers, reciprocal tariffs introduced by the U.S. are likely to affect Chinese tile exports more severely due to the historically higher tariffs and ongoing trade tensions between the U.S. and China. China has been a major target in recent U.S. tariff policies, which include extensive duties on a wide range of Chinese goods, including building materials like tiles. These tariffs increase the cost of Chinese tiles in the U.S. market, making them less competitive.

Indian tile manufacturers may face a comparatively lighter impact. India’s tariffs on U.S. goods tend to be lower, and the U.S. reciprocal tariffs on Indian imports are often less stringent or selectively applied. This relative tariff advantage positions Indian tile exporters favorably, allowing them to offer competitively priced products in the U.S. market during the tariff war.

The Real Cost of the U.S.-China Tariff War on the Flooring Industry

True Impact: How 245%+ Tariffs Disrupted Chinese Tile Imports into the USA

The U.S.-China tariff war has dramatically reshaped the American flooring industry, with tariffs on Chinese tile imports soaring to as high as 245% in 2025. These unprecedented duties, imposed as part of escalating trade tensions and retaliatory measures, have rendered Chinese tiles virtually uncompetitive in the U.S. market. Previously, Chinese ceramic tiles accounted for nearly a third of all U.S. tile imports, but the cumulative effect of countervailing and anti-dumping duties—often exceeding 100% and now reaching up to 245%—has led to a near-total collapse of Chinese tile imports.

Data Insight: Sharp Decline in U.S. Ceramic Tile Imports from China

After the imposition of these steep tariffs, U.S. ceramic tile imports from China plummeted by 98% in both volume and value within the first quarter following the duties, erasing China’s dominant market position almost overnight.

Imports that once totaled around 750 million square feet annually from China shrank to near zero, causing a shortfall of approximately 700 million square feet in the U.S. market.

While U.S. manufacturers attempted to ramp up production, their capacity could only partially fill the gap, leaving a significant supply deficit.

Other countries, notably India, Vietnam, Spain, and Italy, have stepped in to capture market share. India, for example, quadrupled its tile exports to the U.S. in the wake of China’s exit, while Vietnam and Malaysia entered the rankings for the first time, particularly in the low-price segment.

Consequences: Rising Prices, Delayed Projects, and Distributor Losses

Rising Prices: The cost of imported tiles surged as distributors and retailers passed on the higher tariff costs to consumers. Major flooring companies announced price increases—some as high as 7%—to offset the impact of tariffs. With fewer low-cost Chinese options, overall retail prices for flooring have risen, squeezing consumer budgets and reducing discretionary spending on home improvements.

Delayed Projects: The sudden shortage of supply led to delays in commercial and residential projects, as distributors scrambled to find alternative sources. Some popular tile styles and finishes, previously available only from China, became scarce or unavailable, further complicating project timelines.

Distributor Losses: U.S. distributors who relied heavily on Chinese suppliers faced significant financial strain. Many were forced to pay tariffs upfront, tying up cash flow and, in some cases, making it unviable to continue importing certain products. The abrupt shift also left some distributors with overpriced inventory, especially if tariffs were rolled back after stock had been purchased at higher rates.

India’s Amazing Rise as America’s Go-To Tile Supplier

Not Just a Backup Plan: Why India Isn’t a “Second Choice” Anymore

India has rapidly transformed from a secondary supplier into a primary source for flooring tiles in the U.S. market. This shift is not merely a result of the U.S.-China tariff war, but a testament to India’s growing manufacturing prowess, robust export infrastructure, and ability to deliver quality at scale. The surge in demand for Indian tiles is backed by a decade of exponential export growth, with Indian tile exports to the U.S. skyrocketing from just 344,000 square feet in 2013 to nearly 405 million square feet by 2023—a staggering increase that reflects India’s new status as a global tile powerhouse.

Production Scale: India Ranks Among the Top 3 Global Tile Exporters

India now stands as the world’s second-largest producer and, as of 2023, the second-largest exporter of ceramic tiles, trailing only China. Indian tile production has seen consistent growth, reaching 1,266 million square meters in 2019 and continuing to expand, powered by the dynamic Morbi cluster in Gujarat. This scale enables Indian manufacturers to meet large, urgent orders and offer a diverse range of designs and finishes, making them highly competitive internationally.

Why the U.S. Prefers India Now: Lower Anti-Dumping Duties, Friendlier Trade Ties

While the U.S. imposed steep tariffs on Chinese tiles—reaching over 245%—and has taken action against other Asian exporters, Indian tiles have generally faced more moderate duties and fewer trade barriers. For three months following the reciprocal tariff announcement by the U.S. on April 5, 2025, Indian tiles benefited from a temporary 10% tariff, before reverting to a 26% import duty—still lower than the rates for Vietnam (46%), Thailand (36%), and Bangladesh (37%). This tariff advantage, combined with India’s reputation for fairer trade practices and fewer anti-dumping penalties, has made Indian tiles more attractive to American importers.

Best Alternative to China: India’s Preferred Status

India is no longer just a contingency for U.S. buyers; it is the preferred alternative to China for flooring tiles. The combination of competitive pricing, expanding production capacity, and a track record of reliable exports has positioned India as America’s go-to supplier. Even as U.S. industry groups lobby for higher duties on Indian tiles, the country’s share of the U.S. market continues to grow, supported by its ability to deliver quality products at scale and adapt to evolving trade dynamics.

Beyond Pricing — What Makes Indian Tiles Stand Out in 2025

Design Diversity: Indian tiles offer a wide range of contemporary styles that perfectly match current U.S. interior trends, from large-format and textured tiles to natural stone look and wood-look finishes.

Durability Meets Style: Certified by ISO, CE, and ANSI standards, Indian tiles combine strong durability with elegant designs, ensuring long-lasting performance in both residential and commercial spaces.

Eco-Factor: Indian manufacturers use cleaner, more sustainable production methods—like recycled water and energy-efficient kilns—making Indian tiles a greener choice compared to many competitors.

Cost-Effective Flooring Tiles: Thanks to efficient production and lower logistics costs, Indian tiles provide excellent value without compromising on quality, making them the smart option for the U.S. market.

How Ramirro Ceramica Became a Power Exporter Amid Trade Disruptions

Smart Moves: Export-Heavy Strategy Amid Tariffs

When U.S. tariffs disrupted traditional supply chains, Ramirro Ceramica swiftly shifted focus to an export-driven model, capitalizing on growing global demand for Indian tiles. This proactive pivot allowed Ramirro to mitigate tariff impacts and expand its footprint internationally, turning challenges into growth opportunities.

Global Presence: Expanding Reach to 60+ Countries

Ramirro Ceramica now exports to over 140 countries worldwide, including key markets across Asia, Europe, and the Americas. Our recent 2024 business tour across 15+ Asian countries underscores our commitment to global expansion and partnership-building, strengthening brand presence and market penetration.

Custom Solutions for the U.S. Market: Tailored Products and Faster Logistics

Understanding U.S. market demands, Ramirro offers customized tile specifications—such as size, finish, and durability—aligned with American interior trends and building codes. Coupled with efficient logistics from Indian ports, Ramirro ensures timely deliveries, helping U.S. importers maintain steady supply despite trade uncertainties.

Seamless Tile Import-Export Process: How Ramirro Supports the U.S. Market

Ramirro Ceramica simplifies the import-export journey by providing end-to-end support, including quality assurance, eco-friendly packaging, compliance with international standards, and responsive customer service. Our focus on preventive quality control minimizes product failures, ensuring reliable shipments that meet U.S. expectations.

How Ramirro Caters to U.S. Buyers: Tailored Solutions for Wholesalers, Retailers, Architects, and More

Wholesalers: Ramirro supports wholesalers with large order capabilities, flexible shipping options, and ample bulk stock, ensuring they can meet high-volume demands efficiently.

Retailers: Offering a wide variety of tile designs and consistent product availability, Ramirro helps retailers keep pace with evolving U.S. market trends and customer preferences.

Architects: Ramirro provides architects with design flexibility, high-quality finishes, and custom tile options tailored to specific project needs, enabling creative and durable architectural solutions.

Contractors: Focusing on quick turnaround times and reliable logistics, Ramirro ensures contractors receive bulk stock promptly to keep large construction projects on schedule.

How the U.S. Tile Market Is Evolving in 2025: Key Trends You Can’t Miss

Technological Advancements: Digital printing and finishing technologies are enabling tiles that closely mimic natural materials like wood and stone, expanding design possibilities and consumer appeal.

Design Trends: Large-format tiles, geometric patterns, wood-look ceramics, and bold colors dominate, reflecting U.S. interior design preferences for contemporary, stylish, and versatile flooring options.

Sustainability: Eco-friendly tiles made from recycled materials and produced with energy-efficient processes are gaining traction as environmental awareness grows among consumers and builders.

Growth Drivers: Increased spending on residential construction and home renovations is a major catalyst. For example, median home renovation spending reached $24,000 in 2023, with many homeowners exceeding budgets to upgrade kitchens and bathrooms, boosting tile demand.

E-commerce Expansion: The rise of online retail channels, with U.S. e-commerce sales surpassing $285 billion in late 2023, is making tile purchasing more accessible and convenient, further expanding market reach.

Porcelain Tiles Lead: Porcelain remains the dominant product segment due to its durability, suitability for high-traffic areas, and innovative large-format options introduced by manufacturers.

Exclusive Behind-the-Scenes: What U.S. Buyers Love About Ramirro’s Export Experience

Seamless Documentation: Ramirro Ceramica handles all legal and compliance paperwork efficiently, ensuring U.S. importers face no bureaucratic hurdles or delays, making the import process smooth and hassle-free.

Fast Turnarounds: Leveraging strategic locations like Gujarat’s Morbi cluster and Mundra Port, Ramirro offers reduced lead times and reliable shipping schedules, helping U.S. buyers get their orders faster even amid global trade disruptions.

Inventory Assurance: With bulk stock readily available, Ramirro meets the high-volume demands of U.S. wholesalers and distributors, ensuring consistent supply without stockouts or delays.

One Point Contact: Ramirro provides dedicated export teams focused on the U.S. market, offering personalized support and ongoing communication to address buyer needs promptly and maintain strong partnerships.

Data Doesn’t Lie: Numbers That Prove India is the Smartest Choice

Stat Snapshot: India’s tile exports to the USA have surged dramatically, rising from just 344,000 square feet in 2013 to nearly 405 million square feet by the end of 2023—a growth of over 117,000% in a decade, according to Indian government and industry data.

Cost Analysis: Compared to China, Vietnam, and Spain, Indian tiles offer lower landed costs due to competitive manufacturing expenses and efficient logistics. Despite recent increases in freight costs, India’s proximity to major ports like Mundra and Morbi’s production scale help keep overall import costs competitive.

Import Duty on Tiles from China vs India: The U.S. tariff war has imposed steep anti-dumping and countervailing duties on Chinese tiles, often exceeding 245%, while Indian tiles currently face a combined duty of around 11.5% to 26%, including a recent preliminary countervailing duty of about 3% plus the base 8.5% tariff. This significant tariff gap makes Indian tiles more cost-effective for U.S. importers.

Common Myths U.S. Buyers Still Believe — And Why They’re Outdated

Chinese Tiles are Cheaper” — Not Post-Tariff

With U.S. tariffs on Chinese tiles now exceeding 245%, Chinese imports are no longer the budget-friendly option they once were. Indian tiles, with lower import duties and competitive manufacturing costs, now offer far better value to U.S. buyers.

“Indian Tiles Aren’t Durable” — Proven Wrong with Certifications

Indian tiles meet global quality standards, holding certifications like BIS (IS 15622:2017), ISO 9001, and CE, which require rigorous testing for strength, water resistance, and durability.Leading manufacturers, including Ramirro, ensure our tiles are as reliable as any international brand.

“Shipping from India is Slow” — Faster Than Ever

Upgraded infrastructure at major ports like Mundra and streamlined logistics have significantly reduced shipping times from India to the U.S., making delivery schedules highly competitive with other exporting countries.

“Indian Tiles Aren’t Trendy” — Modern Designs Lead the Way

Indian manufacturers now offer a vast range of contemporary designs, colors, and finishes that match or exceed current U.S. interior trends, with advanced digital printing and customization options to suit every project.

Sustainability in the Tile Industry: What U.S. Buyers Should Expect from Indian Manufacturers

Use of Recycled Materials: Many Indian manufacturers incorporate recycled glass, ceramics, and industrial waste into their tiles, significantly reducing reliance on virgin resources and minimizing landfill waste.

Energy-Efficient Production: The industry has adopted solar-powered kilns, energy-efficient machinery, and modern kilns that consume less energy, lowering both carbon emissions and operational costs.

Low-Emission Processes: A shift from coal gas to natural gas and biogas in kilns, as well as the use of renewable energy sources like solar and wind, has helped reduce greenhouse gas emissions across the sector.

Eco-Friendly Packaging: Companies are moving toward recycled or biodegradable packaging materials, further reducing the environmental footprint of their products.

Sustainable Sourcing: Raw materials are increasingly sourced locally to cut down on transportation emissions, and manufacturers are aligning with international standards such as ISO 14001 and LEED certification.

Waste Reduction: Broken and defective tiles are recycled back into production, and advanced waste management techniques are widely implemented to minimize production waste.

Innovation in Product Design: Indian manufacturers are producing durable, versatile, and stylish tiles—including GVT (Glazed Vitrified Tiles)—that are both eco-friendly and meet global design trends.

What This Means for U.S. Buyers:

Lower Carbon Footprint: Indian tiles are produced with a focus on reducing carbon emissions, making them a responsible choice for green building projects.

Assured Quality and Compliance: Many Indian manufacturers hold certifications for environmental management and product quality, ensuring compliance with U.S. and international sustainability standards.

Competitive Advantage: With growing global regulations like the EU’s Carbon Border Adjustment Mechanism (CBAM), Indian manufacturers’ investment in green technologies gives U.S. buyers a competitive edge in sustainable sourcing.

The Smart Buy — Why Ramirro Ceramica is America’s Best Bet in 2025

Right Product, Right Price, Right Time

Ramirro Ceramica delivers an extensive range of porcelain and ceramic tiles, including the latest trends for 2025—think earthy terracotta tones, geometric patterns, and luxurious marble looks—ensuring U.S. buyers always find the perfect fit for any project. Our diverse finishes and sizes cater to both residential and commercial needs, while competitive pricing and reliable supply chains guarantee value and availability when it matters most.

Trust Built Over Time: 100+ Container Exports Annually to the U.S.

Ramirro Ceramica’s proven track record includes exporting over 100 containers annually to the U.S., earning trust through consistent quality, timely deliveries, and a customer-first approach. Our global presence and experience make us a reliable partner for American wholesalers, retailers, and project managers.

Ramirro Tile Export Services: Comprehensive Support for U.S. Buyers

U.S. buyers benefit from seamless documentation, dedicated export teams, and tailored logistics solutions that simplify the import process. Ramirro’s expert support—from product selection to after-sales service—ensures a hassle-free experience, making us the go-to choice for anyone seeking quality, innovation, and reliability in 2025.

-

DOVE – Grey Full Body Tiles

DOVE – Grey Full Body Tiles -

SINTETICO-GREY Marble Look Porcelain Tiles

SINTETICO-GREY Marble Look Porcelain Tiles -

SINTETICO BIANCO Marble Look Porcelain Tiles

SINTETICO BIANCO Marble Look Porcelain Tiles -

SAHARA-GREY Marble Look Porcelain Tiles

SAHARA-GREY Marble Look Porcelain Tiles -

MYSTIQUE CREMA Marble Look Porcelain Tiles

MYSTIQUE CREMA Marble Look Porcelain Tiles -

MONTERA RIO Marble Look Porcelain Tiles

MONTERA RIO Marble Look Porcelain Tiles -

CALCATTA ORO Marble Look Porcelain Tiles

CALCATTA ORO Marble Look Porcelain Tiles -

APEN SILVER Marble Look Porcelain Tiles

APEN SILVER Marble Look Porcelain Tiles -

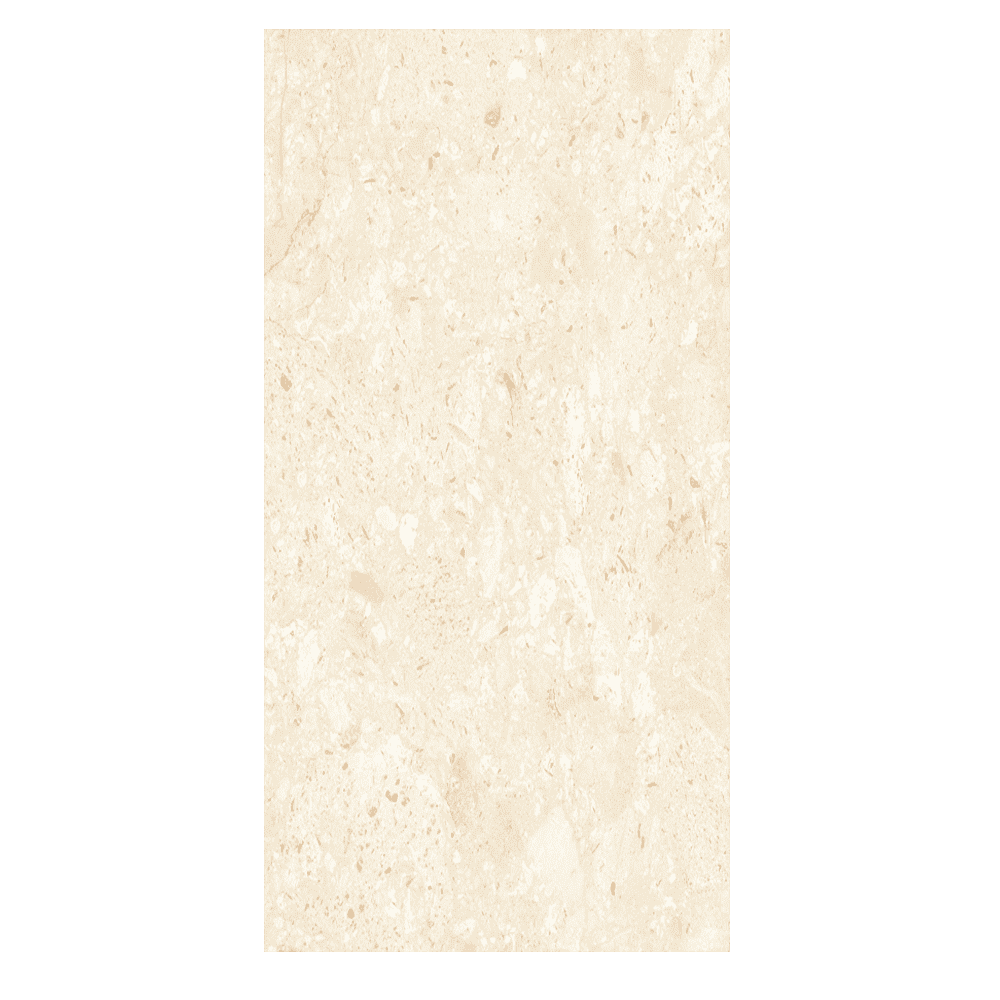

TERRAZZO BEIGE Marble Tile Design for Porcelain

TERRAZZO BEIGE Marble Tile Design for Porcelain -

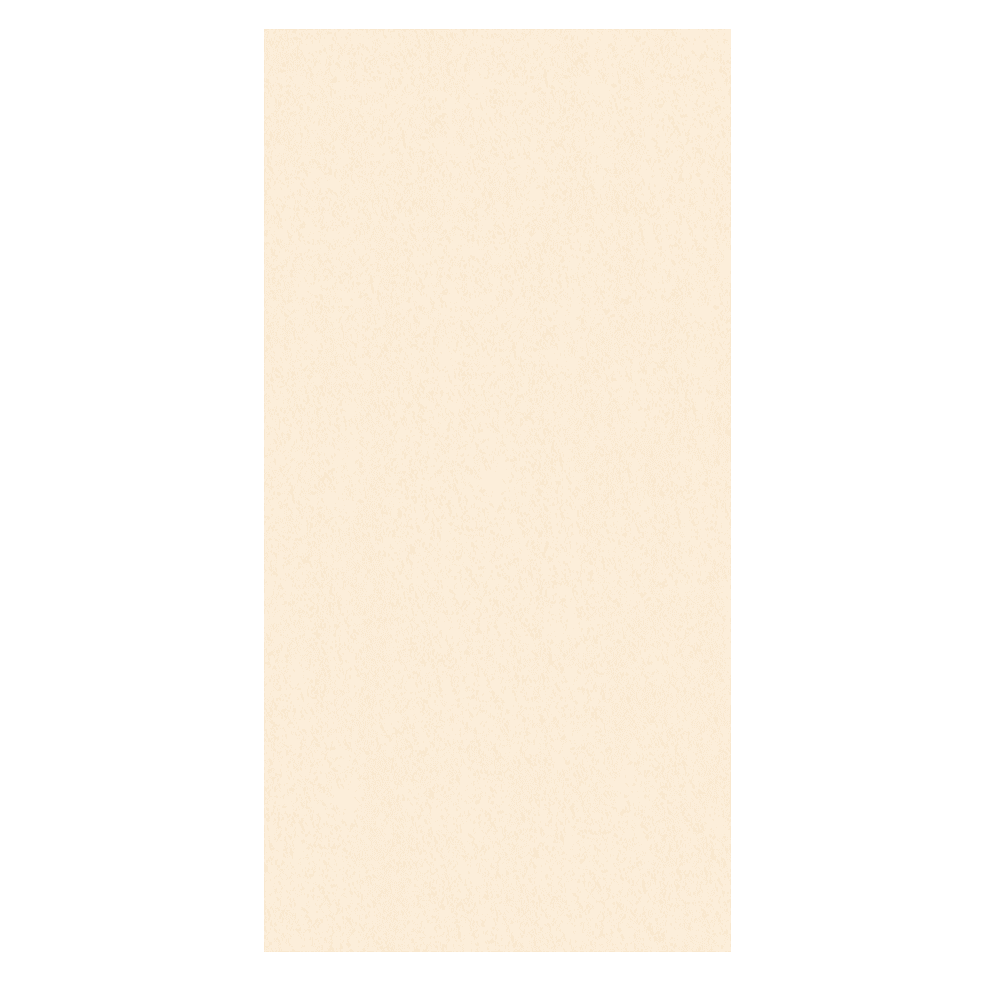

TROPICANA WHITE Marble Tile Design for Porcelain

TROPICANA WHITE Marble Tile Design for Porcelain -

WILLIAM GREY Marble Tile Design for Porcelain

WILLIAM GREY Marble Tile Design for Porcelain -

TROPICANA CREMA Marble Tile Design for Porcelain

TROPICANA CREMA Marble Tile Design for Porcelain -

TRAVENTINO ROYAL Marble Tile Design for Porcelain

TRAVENTINO ROYAL Marble Tile Design for Porcelain -

STATUARIO PEARL Marble Tile Design for Porcelain

STATUARIO PEARL Marble Tile Design for Porcelain -

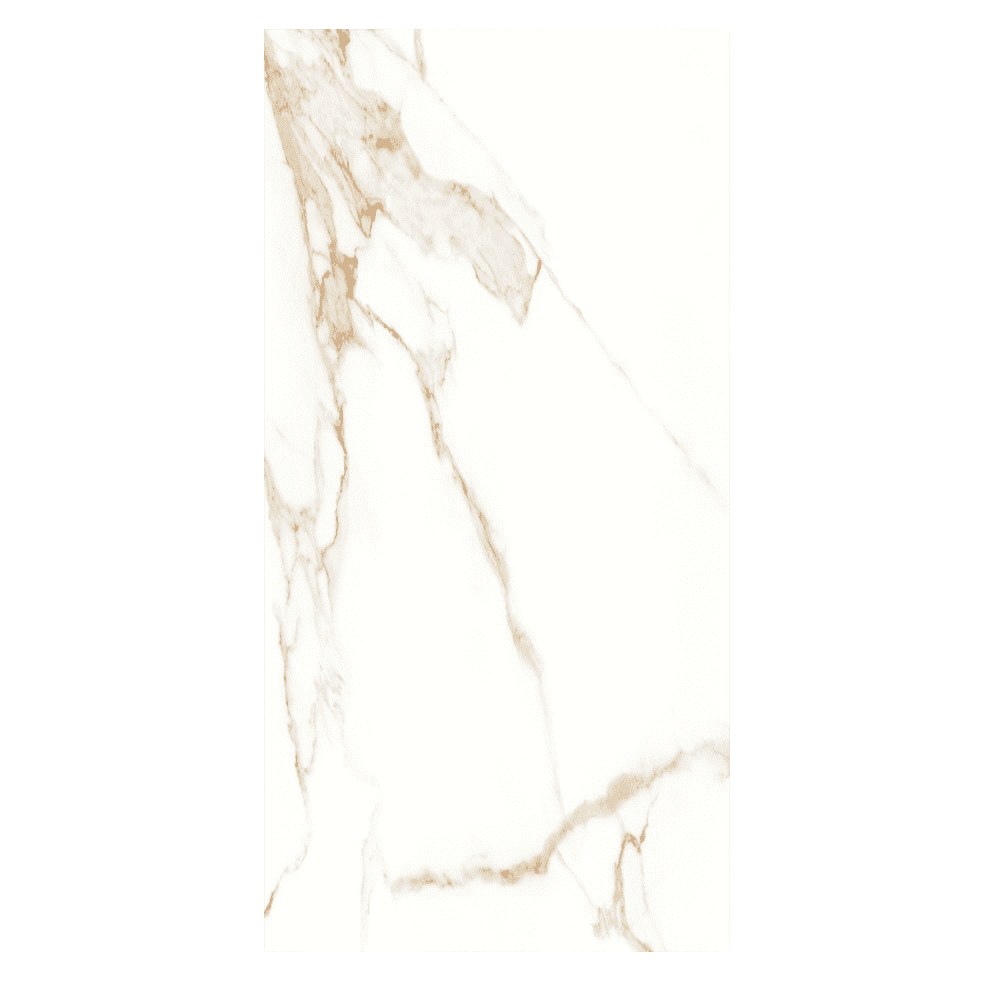

STATUARIO GOLD Marble Tile Design for Porcelain

STATUARIO GOLD Marble Tile Design for Porcelain -

SEAMLESS STATUARIO Marble Tile Design for Porcelain

SEAMLESS STATUARIO Marble Tile Design for Porcelain -

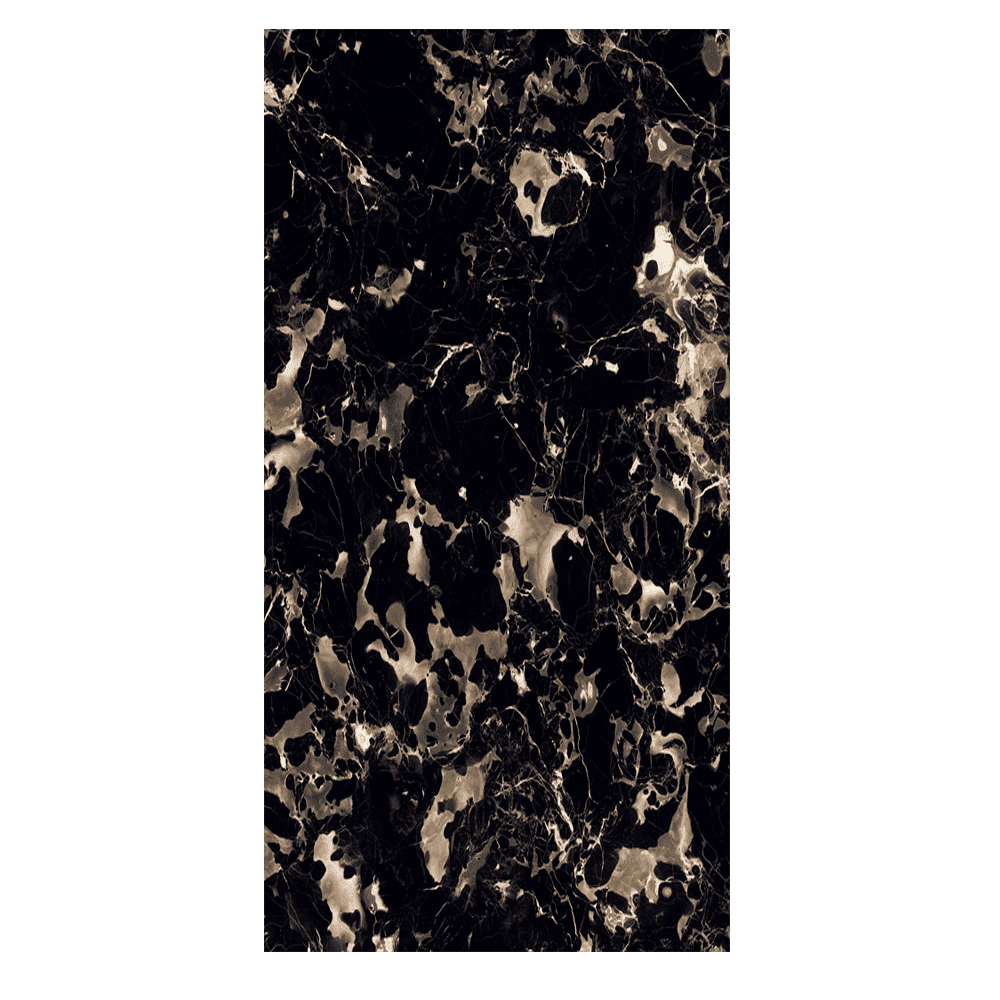

PORTORO BLACK Marble Tile Design for Porcelain

PORTORO BLACK Marble Tile Design for Porcelain -

NOVANA GREY Marble Tile Design for Porcelain

NOVANA GREY Marble Tile Design for Porcelain

Want Tariff-Free Peace of Mind? Let Ramirro Handle Your Tile Supply Chain

Looking for a seamless, tariff-free solution for importing ceramic and porcelain tiles from India to the USA? Ramirro Ceramica is your ideal partner, offering unmatched expertise in Indian export, top-quality india-made products, and a proven track record in exports to the US. As a leading india-based manufacturer, Ramirro specializes in wholesale product exports, making it easy for U.S. buyers to access the best export products from India and meet the rising demand for imports from India in the American market.

Ramirro’s extensive global reach—exporting to over 140 countries, including the United States—demonstrates why India’s exports are among the top exports worldwide. With trade relations between the United States and India stronger than ever, and india-us trade continuing to grow, U.S. importers have imported more from India as India and the US increased their trade cooperation in recent years. Ramirro’s streamlined logistics, fast shipping via Gujarat and Mundra Port, and comprehensive support ensure your us imports arrive on time and without legal headaches.

Whether you’re a wholesaler looking for bulk stock, a retailer seeking trendy designs, or an architect needing custom solutions, Ramirro’s export services cover every need. Our expertise in India import and export data, compliance with trade regulations, and dedication to quality make us the smart choice for anyone navigating the evolving landscape of India to united states product exports.

Experience peace of mind with Ramirro—where India’s exports to the United States are made easy, reliable, and cost-effective. Contact us today to see how our India-based team can streamline your tile import-export process and help your business thrive in the growing India-us trade environment.

Shop Now | Chat With Expert | View Catalogue

Why Should You Trust us?

Here’s what you get out of our article. Our team have various Ceramic Experts with experience of more than 25 Years, researches on problems our customer faces in tiling industry.

Ramirro Ceramica, – One of The Leading Tiles Manufacturer and Supplier globally, helps you people gain knowledgeable insight before making your purchase decision for products related to the floor and wall tiles.

So, we have closely monitored all kinds of trends in the ceramic tiles manufacturing world, from the old days of clay and plain color to modern digital, realistic-looking designs printed on ceramics with high-depth effects.

Our tiling Experts have seen thousands of different tiles patterns, sizes, materials, pricing, and installation techniques throughout their career.

Their expertise shared with you in simplified and organised way, helps you choose and make better decision before purchasing any flooring option available in market.

Brief about Company:

Ramirro is one of the finest Tiles manufacturers in India manufacturing porcelain and ceramic tiles. Our products have a variety of sizes and types of tiles ranging from Ceramics, porcelain, Full body etc. This helps you choose the perfect fit for your project. Plus, our collection will help you get inspiration from the architect’s design.

Here’s some more helpful links that showcase our users trust on Ramirro Ceramica Brand:

– Growth in International Market

– Trusted and Licensed Exporter

– Manufacturing Plant in India

Here’s our social proof by LinkedIn competing with top known global tiling brands: